TL;DR

Kadena, a Layer‑1 blockchain organisation that reached a multi‑billion valuation in the 2021 cycle, abruptly ceased operations in October 2025 via a tweet. They will not be the last Web3 organisation to end things this way.

From its 2016 founding as a JPMorgan spinout to its abrupt October 2025 shutdown, Kadena’s story underscores a critical divide in Web3: innovative technology undermined by organisational fragility. The core organisation ceased operations and maintenance, citing market conditions, leading to a sharp price drop and a series of delistings.

As of 18 January 2026, KDA trades around $0.009 USD with a market cap around $3.0 million, remaining over 99% below its ~$27.64 all-time high in 2021. CoinMarketCap snapshot. The network persists under miners and community maintainers, but the company’s end highlights weak execution, unclear revenue, and poor governance signals.

This is not a tech failure. Chainweb’s scalable Proof‑of‑Work and Pact’s security‑focused contracts held promise, but this was a business failure, exposing Web3’s lack of operational guardrails. Comparable in trust erosion to major collapses like FTX (impact-wise, not alleging fraud), Kadena signals the first of many cases where engineering excellence meets organisational inadequacy.

Why did Kadena fail? Kadena failed because its core organization could not sustain operations through the 2025 downturn. In October 2025 the team announced it would cease all business activity and active maintenance, citing market conditions and an inability to continue development. The Defiant · Binance.US notice. The shutdown, combined with unclear revenue, weak governance signals, and sudden communication, triggered a price crash and exchange delistings even though the chain can still run under miners.

We work with many Layer-1 and infrastructure teams. A pattern repeats: teams can explain token mechanics and consensus, yet cannot state a plain business model or show a cadence of delivery that sustains confidence through downturns. Kadena fits that pattern. The engineering case was real; the operating case was not.

When code is excellent but the company is brittle, investors are exposed. Technical professionalism is necessary; organizational credibility protects capital.

The Pedigree Paradox: “Institutional” Credentials vs Operational Reality

In Web3, “institutional” often gets treated as a shortcut for “competent.” Kadena looked like the exception to crypto’s anonymous-founder stereotype: a team with enterprise backgrounds and serious engineering. But the shutdown showed a familiar mismatch: strong technical credibility does not automatically translate into strong operating discipline.

| Perception | Observed outcome | What to verify |

|---|---|---|

| Enterprise pedigree implies governance maturity | Abrupt cessation created a continuity shock | Shutdown announcement wording, timing, and any transition plan |

| Serious engineering implies long-term stewardship | Markets repriced continuity risk faster than architecture | Price reaction window + exchange actions (with primary notices) |

| Large ecosystem programs imply sustained ecosystem outcomes | Outcomes became difficult to validate publicly at shutdown | Public recipients, milestones, and measurable adoption outcomes |

What Happened to Kadena in October 2025: Shutdown Announcement and Market Fallout

Around 21 to 22 October 2025, Kadena’s core organization announced that it would cease all business operations and active maintenance of the Kadena blockchain, citing market conditions and an inability to sustain development. This was an organizational shutdown rather than a technical failure; the chain can continue under miners and community maintainers. Primary reporting · Exchange notice referencing shutdown

Market reaction was immediate. Within roughly 24 hours of the shutdown post, KDA fell about 60% (some reporting put the drawdown closer to ~65%), before continuing to trade more than ninety-nine percent below its peak. Source (The Defiant) · Source (Decrypt)

Exchanges responded quickly. Bybit ended KDA/USDT spot trading on 28 October and OKX delisted KDA spot pairs on 29 October, Binance.US scheduled delisting for 28 October, KuCoin followed with removal on 4 November, and Binance announced global delisting of all KDA spot pairs effective 12 November. Bybit · OKX · Binance.US These delistings reduced liquidity for KDA and made it harder for holders to adjust their positions.

This sequence created a clear pattern: a sudden organisational exit, a sharp price crash, and rapid delistings. Most reporting distinguished between Kadena the company, which ended, and Kadena the proof-of-work chain, which may continue as a community-run network.

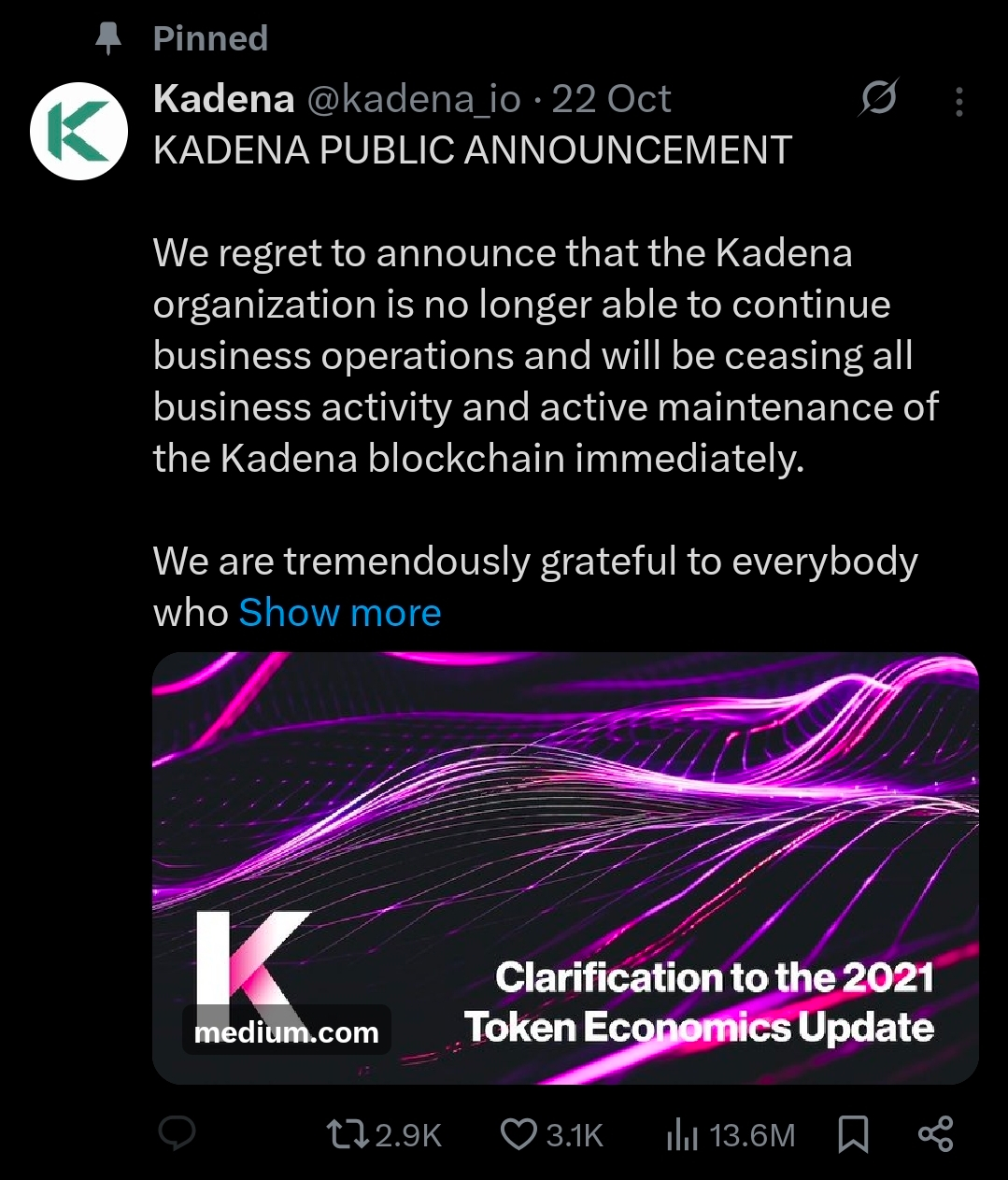

The tweet that crystallised the continuity crisis: a shutdown communicated as a short public post rather than a managed transition.

The Communication Gap: Why the Shutdown Hit Like a Rug Pull (Without Being One)

A project can end without being a fraud, but still create a rug-pull-like experience for holders if the shutdown is sudden and unmanaged. The key issue is not intent; it is continuity risk. When an organisation that stewards a chain exits abruptly, the market reacts as if the floor has disappeared. Reporting on the shutdown communication

- Suddenness: an immediate cessation creates maximum uncertainty for users, builders, and exchanges.

- No clear transition plan: without a communicated handover path, even a technically live network becomes operationally fragile.

- No runway framing: in downturns, stakeholders want to understand whether a shutdown is preventable, planned, or forced.

This is where operational guardrails matter: the market can tolerate bad news, but it cannot tolerate surprise.

X / Tweet History Snapshot: How Sentiment Shifted Into a Continuity Crisis

One of the most useful public signals in Web3 is not a quarterly report; it is the project’s own communication trail. A tweet history is not proof of anything by itself, but it is a reliable way to track whether a team is managing expectations, acknowledging risk, and preparing stakeholders for negative outcomes.

Business as usual, one day before shutdown: conference travel messaging that implied continuity.

Below is a snapshot of key public communications leading into the shutdown. The goal is simple: map what was being communicated against what happened next.

| Date (UTC) | Account | Message theme | What it implied | Link / archive |

|---|---|---|---|---|

| 2025-10-20 | @kadena_io | Business-as-usual / event & ecosystem promotion | Normal operations; continuity assumed days before the shutdown notice. | Screenshot captured in this article (see image above). |

| 2025-05-20 | Kadena (official site) | Growth narrative / ecosystem incentives | Signals expansion and builder momentum rather than runway stress. | Grant announcement |

| 2025-10-21 | @kadena_io | Shutdown / cessation notice | Continuity ends; exchanges reprice maintenance and liability risk. | Reporting with embedded official statement Binance.US cites the official shutdown wording |

| 2025-11-15 to 2025-12-18 | Community maintainers | Fork / maintenance / community takeover | Decentralized survival attempt: community-run fork, tooling, and roadmap. | KDA Community Edition (Medium) KDA Community repos (GitHub) Miner/pool support note (f2pool) |

How we’ll use this: if “business as usual” messaging continues right up until a sudden shutdown, that is a measurable governance and disclosure failure, even if the underlying chain keeps producing blocks.

Timeline: From Shutdown Announcement to Delistings

- 21–22 October 2025 – Kadena’s core organization announces it will cease all business operations and active maintenance of the blockchain.

- Within ~24 hours – KDA fell about 60% (some reporting put the drawdown closer to ~65%). The Defiant · Decrypt

- 28 October 2025 (08:00 UTC) – Bybit delists the KDA/USDT spot pair (spot trading ends). Bybit notice

- 29 October 2025 (08:00–10:00 UTC) – OKX delists KDA spot trading pairs (KDA/USDT, KDA/USDⓈ). OKX notice

- 28 October 2025 – Binance.US schedules KDA delisting. Binance.US notice

- 4 November 2025 – KuCoin schedules removal of KDA. KuCoin notice

- Early November 2025 – Network upgrade / hard-fork window referenced by mining infrastructure (payouts temporarily suspended during upgrade coordination). f2pool note

- Mid‑Nov to Dec 2025 – Community maintainers publish fork / continuity efforts (KDA “Community Edition”) and supporting repositories. Community posts · GitHub

- 12 November 2025 – Binance announces global delisting of all KDA spot pairs. Binance notice

- 12 January 2026 (03:00 UTC) – Binance ended withdrawals support for KDA on the community‑maintained chain (withdrawal window closed). Binance notice

Post-shutdown, parts of the community attempted to keep the network alive through miner-led maintenance and fork initiatives, while exchanges treated continuity as time-bounded (for example, Binance had communicated a withdrawals-support window for the community-maintained chain that ended on 12 January 2026). Reporting and exchange notices also reference a network upgrade / hard-fork window around early November 2025. Separately, community discussion on X reflected ongoing disputes about transparency, remaining issuance schedules, and what continuity should look like without a core team. These debates matter less for the chain’s raw uptime than for whether an ecosystem can retain credibility and users without an accountable operating organization.

A Decade of Promise and Peril – Kadena’s Timeline

Kadena’s trajectory, from a Wall Street‑backed innovator to a community‑maintained survivor, illustrates how execution gaps can eclipse technical achievements. The public record shows meaningful technical milestones and repeated ecosystem pushes, followed by an abrupt organisational end. The table below consolidates the highest‑signal events that frame the failure as organisational rather than technical.

Methodology note: this timeline is constructed from publicly verifiable announcements, exchange notices, and archived communications. It does not rely on internal disclosures or private reporting.

| Date | Event | Why it matters |

|---|---|---|

| 2016 | Founding | Enterprise-rooted team and a PoW scalability thesis set high expectations for governance and execution. |

| 2018 | Early funding reported | Capital enabled multi-year engineering, but a durable revenue model remained unclear publicly. |

| 2019–2020 | Public chain and early mainnet era | Shift from building the protocol to proving demand and ecosystem pull. |

| 2021 | Bull-market peak | Valuation masked operating weakness; price peaked near ~$27.64 while sustainable adoption remained debated. |

| Apr 2022 | $100M ecosystem program announced Business Wire | Large announcements create expectations—execution and measurable outcomes become the real test. |

| 2022–2023 | Ecosystem pushes and pilots | Technical progress continued, but evidence of sustained user growth remained limited publicly. |

| 2025 | Additional ecosystem funding + late partnerships $50M grants announcement | Late-cycle pivots and partnerships did not restore confidence or traction ahead of shutdown. |

| Oct 21–22, 2025 | Shutdown announcement The Defiant · Binance.US notice | Abrupt cessation signaled governance and runway failure; markets repriced immediately. |

| Late Oct–Nov 2025 | Delistings and liquidity deterioration | Exchange actions amplified investor harm; continuity risk became real, not theoretical. |

Case Study: Ecosystem Funding Announcements vs Ecosystem Outcomes

Kadena repeatedly signaled ecosystem intent through funding announcements. That approach can work, but only if the downstream outcomes are publicly measurable: shipped products, retained developers, users, and durable liquidity. Where this became fragile for Kadena was not the existence of ecosystem programs, but the difficulty of verifying results through the cycle.

| Program (announced) | Date | Amount (announced) | Stated goal | Publicly verifiable outcomes |

|---|---|---|---|---|

| Ecosystem / builder grants program (Kadena Eco) | Apr 2022 | $100M (announced) | Grow builders and applications across DeFi, NFTs, gaming and DAOs. | Primary announcement exists, but a complete public outcomes ledger (recipients → milestones → adoption) is difficult to reconstruct from official disclosures alone. Announcement |

| Chainweb EVM / AI / Tokenization grants | May 2025 | $50M (announced) | Revive adoption via EVM compatibility, RWA tokenization, and AI-driven use cases. | Clear program framing and allocation details are published, but outcomes (shipped products + retained TVL/users) were not clearly evidenced as having recovered pre-shutdown. Announcement |

Outcomes proxy (TVL): DeFiLlama-reported total value locked (TVL) for Kadena fell to roughly $128k in late October 2025 (reported as down ~71% in 24 hours), versus an estimated peak near $11M in August 2022. This is not a perfect measure of adoption, but it is a public, comparable signal of retained liquidity through a cycle. DeFiLlama (Kadena) · Reporting citing DeFiLlama This TVL collapse is widely cited as evidence that ecosystem funding announcements did not translate into retained liquidity or user demand through the downturn.

Public adoption signals (triangulation): to avoid relying on a single metric, here are three public proxies that tend to move together when real usage is present:

- Liquidity retained (TVL): DeFiLlama TVL (above) shows how much value remains deployed in the ecosystem through time.

- On-chain activity (proof-of-life, not demand): transaction and chain activity trackers can confirm the network is still producing blocks and processing transactions, but they do not prove that the ecosystem has retained users or builders. BitInfoCharts (Kadena) · Chainweb explorer

- Developer activity (maintenance signal): repository and commit activity can indicate whether a chain is being actively maintained after an organisational shutdown. Community repos

Why this matters: large numbers and big programs are easy to announce. What investors need is an outcomes ledger: who received funding, what shipped, and what adoption followed.

Technical Strength Was Not the Problem: Where Kadena’s Layer-1 Fell Short

Kadena’s design combined Chainweb for parallelized Proof of Work throughput with Pact for safer, readable smart contracts. Chainweb’s architecture uses multiple parallel chains designed to scale throughput without abandoning PoW security assumptions. Pact’s human-readable approach and verification-oriented design aimed to reduce common smart-contract failure modes. The repositories and documentation show sustained technical effort, and ecosystem features like NFTs and bridging reflected real engineering output.

None of this saved investors when basic company functions failed: revenue clarity, runway discipline, communication, and governance. Kadena is a clean example of a recurring Web3 gap: a project can be technically serious and still be organisationally brittle. When that brittleness shows up as an abrupt shutdown, markets don’t reward architecture. They punish continuity risk.

Market Timing Headwind: Proof-of-Work in a Proof-of-Stake Narrative

Beyond execution, Kadena faced a worsening narrative environment. From 2021 onward, market preference shifted decisively toward proof-of-stake systems, driven by ESG concerns, institutional mandates, and Ethereum’s transition. Even highly efficient proof-of-work designs were increasingly filtered out at the allocation stage.

This does not invalidate Chainweb’s technical merits. It does, however, raise the bar for operating credibility. When a project swims against prevailing market narratives, it must compensate with exceptional clarity on revenue, governance, and continuity. Kadena entered this phase without those buffers.

Key implication: timing does not determine success on its own, but it amplifies weaknesses. As proof-of-work became harder to justify externally, operational fragility became less survivable.

Token Emissions and Sell Pressure (Design-Level Observation)

Kadena’s collapse cannot be explained by token design alone, but emissions dynamics likely amplified downside pressure once confidence broke. As with many proof-of-work networks, ongoing token issuance rewarded miners regardless of demand conditions. In the absence of sustained organic usage or offsetting demand, those emissions can translate into continuous sell pressure during downturns.

This is a general structural observation, rather than a claim about precise allocations. Public sources vary on exact supply schedules, circulating supply figures, and long-term emission curves. Those numbers also change over time. Without a single authoritative and current tokenomics disclosure, it would be misleading to present fixed percentages or caps as settled facts.

The more important point for investors is not the exact split, but the interaction between emissions and demand. When a project lacks clear revenue, strong governance signals, and visible ecosystem pull, token issuance becomes a stress multiplier rather than a growth tool. Kadena’s experience fits that broader pattern.

RMA™ Alignment Assessment (Public-Record View)

This assessment applies VaaSBlock’s RMA™ framework strictly to what could be independently verified from public-facing information at the time of Kadena’s shutdown. It does not rely on private data, internal access, or post-hoc assumptions. Where evidence is insufficient, the outcome is recorded as Unverified, rather than inferred or scored.

| RMA™ Area | Alignment Status | Public Evidence Basis | Investor Interpretation |

|---|---|---|---|

| Revenue Model | Unverified | No audited revenue disclosures; no public breakdown of protocol, enterprise, or services revenue. | Sustainability could not be independently assessed by external stakeholders. |

| Governance | Unverified | No published runway policy, shutdown framework, or decision rules visible publicly. | Continuity and decision-making risk remained opaque. |

| Results Delivered | Unverified | Announcements and pilots visible; outcome tracking and adoption KPIs not consistently published. | Execution confidence weakened over time. |

| Team Proficiency (Operational) | Unverified | Strong technical credentials visible; operational maturity and controls not documented publicly. | Capability beyond engineering could not be assessed. |

| Technology & Security | Exceeds Standard | Chainweb architecture, Pact language design, and third-party security reviews publicly documented. | Protocol strength was not the limiting factor. |

Important: “Unverified” reflects insufficient public evidence, not proof of failure. The absence of disclosure itself still represents a material risk signal for investors evaluating continuity and downside protection.

About CertiK: What Smart-Contract Audits Do, and What They Don’t Cover

CertiK is a smart-contract and protocol security firm. Their scope is code and security posture. It is not a verdict on business viability. Historical snapshots show Kadena present on Skynet with an audit workflow visible at one point; the current page shows different status. Status changes on these portals can occur for a range of reasons and are best cross-checked against official project communications and other independent sources. That is a reminder to investors: security portals evolve with new information, and a code review cannot replace governance, revenue clarity or transparent communication.

For company-level assurance, look at standards that address organization and controls: SOC 2 and ISO/IEC 27001. These do not prove market fit, but they signal maturity in how a team manages risk.

This is part of a broader credibility gap: standards can exist, but verification and interpretation still break down in practice. For a deeper dive on why the “standards layer” itself can be gamed without verifiable proof, see: From Paper to Proof: Why On-Chain Verification Closes the Trust Gap in Industry Standards.

Investor Harm and the Confidence Problem After the Kadena KDA Price Crash

The shutdown, the price fall and the subsequent delistings produced direct losses for holders and a broader shock to market trust. From a risk-analysis perspective, my view is that the confidence damage from this episode sits in the same league as prior collapses that shook the market. Again, this is a comparison of impact, not intent, grounded in observable market behaviour rather than legal findings. When assumptions about continuity vanish in a day, retail holders usually bear the loss. This dynamic mirrors broader exchange operational risk patterns, where continuity assumptions break faster than users can react.

Second-Order Effects: Why These Failures Compound Beyond One Project

- Regulatory pressure increases: high‑profile organisational failures strengthen the case for stricter disclosure, governance, and consumer‑protection rules across the sector.

- Talent exits accelerate: experienced operators become more reluctant to join crypto projects where business failure, not technical risk, dominates outcomes.

- Trust costs rise: investors demand higher risk premiums, exchanges de‑risk faster, and builders hesitate to commit to ecosystems without clear continuity signals.

For an example of the kind of failure analysis journalists keep citing, see our report on continuous failures at a major exchange: Upbit CEX: a continuous pattern of failure.

If this pattern feels familiar, see our longer analysis of recurring execution failures across Web3: Amateur Hour in Web3.

Why Kadena’s Collapse Was Predictable: A Pattern Across Layer-1 Projects

We have seen other chains with credible engineering and weak operating models stumble for the same reasons. Without governance, revenue clarity and disciplined communication, engineering cannot defend investor capital through a cycle. There are strong indications it will not be the last time. Prolonged downturns and tighter scrutiny tend to expose organisations without robust governance and revenue structures. The same forces shaping Kadena’s collapse are visible across broader markets, as outlined in AI, SaaS and Crypto in 2026: the reality check.

Case Study: Terra (2022 Collapse)

Terra’s UST model promised innovation and scale, but weak governance and brittle assumptions amplified risk when market conditions turned. The lesson is similar: without operational guardrails and disciplined decision-making, even sophisticated engineering narratives can collapse into a confidence crisis that retail holders pay for.

Case Study: RChain (2017–2023 Fade)

RChain pursued ambitious scalability ideas and raised significant capital early, yet execution delays, unclear adoption, and weak operational follow‑through led to a long fade. The parallel to Kadena is not the technology—it is the pattern: building complex systems without proving durable demand and organisational competence through a cycle.

What Credible Layer‑1 Organisations Look Like to Investors

For investors evaluating other Layer‑1 blockchains after Kadena, credible organisations usually:

- State a plain business model and show confirmed demand; do not hide behind slogans.

- Publish governance, runway, and decision rules so holders understand how choices are made.

- Adopt the right standards: code audits for code; SOC 2 or ISO/IEC 27001 for company controls; RMA™ to connect it all to results and transparency.

- Disclose methods when you present results. If you publish numbers, publish how you got them.

In practice, investors can look for verifiable artefacts, such as publicly accessible policies, attestation reports, or transparent release notes, rather than relying on slogans alone.

See our trust framework note: Transparency Score launched.

For a deeper exploration of how credibility, revenue discipline and governance will determine which organisations survive the next cycle, review our new 2026 foresight editorial.

FAQs: Why Kadena Failed and What It Means for Layer-1 Investors

For traders, the key questions are usually: continuity risk (can this happen to other holdings?), liquidity (can I still exit or withdraw?), and the technical post‑mortem (did the protocol actually break?). The FAQs below address each of those lenses using publicly verifiable sources.

- Why did Kadena fail? Kadena failed at the organisational level, not because of a protocol flaw. In October 2025, the core team announced it would cease operations and active maintenance after failing to sustain the business through the downturn. The abrupt shutdown, unclear revenue model, and weak governance signals destroyed confidence, triggering delistings and a price collapse.

- Did Kadena’s technology fail? No. Kadena’s blockchain technology did not “fail” in the way a protocol exploit or consensus bug fails. Chainweb (its parallel‑chain Proof‑of‑Work design) and Pact (its security‑focused smart‑contract language) remained technically functional, and the network could continue producing blocks under miners and community maintainers. The failure was organisational: the company responsible for maintenance, ecosystem coordination, and continuity planning shut down, and markets repriced that stewardship risk immediately.

- Is Kadena still running after the shutdown? Yes, the Kadena blockchain can still run as a Proof‑of‑Work network maintained by miners and community developers. However, the original operating organisation no longer exists. The key issue is not uptime, but whether a network without accountable stewardship can sustain ecosystem value, development, and exchange support.

- What does “community-maintained” mean in practice? It usually means the original company is no longer paying engineers, publishing official releases, running core infrastructure, or coordinating exchanges—so maintenance depends on independent developers and miners. In practice this can include community-run forks, volunteer release management, and ad-hoc infrastructure support (explorers, nodes, and tooling). A chain can keep producing blocks under miners, but continuity for users depends on whether the community can sustain software updates, security responses, and exchange integrations over time.

- Can KDA still be traded? In limited form, yes—but access is constrained. After major exchange delistings, KDA trading shifted to fewer venues and thinner liquidity. Availability depends on your jurisdiction and which exchanges still list KDA, and some platforms may support withdrawals only for a limited period. This is not trading advice; it is a continuity note: once large venues delist, price discovery and exit liquidity typically deteriorate.

- Can I still withdraw KDA from exchanges? It depends on the exchange and your jurisdiction. Some platforms set time‑bounded withdrawal windows after delisting. For example, Binance communicated a withdrawals‑support window for KDA on the community‑maintained chain that ended on 12 January 2026 (03:00 UTC). Binance notice. Always check your exchange’s latest notice before assuming withdrawals remain available.

- When did Kadena shut down? Kadena’s core organisation announced it would cease business operations and active maintenance around 21–22 October 2025. The announcement was followed within weeks by major exchange delistings and a sharp market repricing, even though the blockchain itself did not immediately halt.

- Why did exchanges delist Kadena so quickly? Exchanges delisted Kadena because the shutdown created continuity and maintenance risk. When the organisation responsible for development and stewardship exits abruptly, exchanges reassess operational liability, liquidity, and user protection. Even if a chain keeps running, the loss of an accountable operator is often enough to trigger delistings.

- Why did Kadena’s shutdown feel like a rug pull to some holders? A project can end without being a fraud and still create a rug‑pull‑like experience if the shutdown is sudden and unmanaged. The key issue is continuity risk. When the floor disappears overnight, holders experience the outcome as a shock, even if no theft is proven.

- Is Kadena a rug pull or a scam? There is no confirmed evidence that Kadena was a rug pull in the classic sense of stolen funds. The harm came from an abrupt organisational shutdown, a sharp KDA price crash and rapid exchange delistings, not a documented theft event. It remains a serious failure of stewardship and communication, which is different from a proven fraud case.

- Was there a transition plan when Kadena shut down? Not in a form that was clearly documented and publicly verifiable at the time of the announcement. Community efforts later attempted to maintain continuity, but the initial shutdown communication did not provide a fully transparent handover framework.

- Were there warning signs before the shutdown? The most visible warning signs were not technical. They were operational: limited verifiable disclosure around revenue, runway, and governance decision rules, plus difficulty validating ecosystem outcomes through the cycle.

- Did Kadena have a clear revenue model? Based on the public record, the company did not provide audited or consistently verifiable disclosures that allowed external stakeholders to assess recurring revenue, sustainability, or runway with confidence.

- What happened to Kadena’s ecosystem and grants? Kadena announced multiple ecosystem programs and initiatives over time, but it became difficult for external observers to verify outcomes, recipients, and measurable adoption through the downturn. Investors should look for an outcomes ledger: who received funding, what shipped, and what usage followed.

- Is Kadena’s collapse similar to Terra or other Layer‑1 failures? The mechanisms differ, but the pattern overlaps: when governance, transparency, and operational discipline are weak, confidence can collapse rapidly, even if the underlying technology story is sophisticated.

- What does Kadena’s failure say about Web3 more broadly? It reinforces that engineering is not enough. Many Web3 organisations can explain consensus and token mechanics but cannot demonstrate durable revenue, governance clarity, and continuity planning through a down cycle.

- Were insiders accused of wrongdoing? Allegations of insider shorting and other misconduct circulated in secondary reporting and community discussion, but these remain unconfirmed in the public record. This article focuses on systemic operational gaps that are observable without relying on unproven claims.

Sources and Evidence

Evidence tiers: Tier 1 = primary notices and official announcements (highest reliability). Tier 2 = reputable journalism and major data aggregators. Tier 3 = community/social sentiment (context only, not factual proof).

- Tier 1–2: Kadena shutdown announcement (Oct 2025): The official Kadena communication was issued as an X post stating the organization would cease business operations and active maintenance immediately. For durability, this article relies on third-party sources that reproduce the wording and on exchange notices that reference the shutdown context. Binance.US notice · Binance withdrawals support notice (community-maintained chain) · Reporting (The Defiant)

- Tier 1: Exchange delistings (named notices): Binance.US delisting notice (Oct 28, 2025) · Bybit delisting notice (Oct 28, 2025) · OKX delisting notice (Oct 29, 2025) · KuCoin delisting notice (Nov 5, 2025) · Binance withdrawals support notice (ended Jan 12, 2026)

- Tier 2: Price and market data: Historical and current KDA price, market cap, and all-time-high data from CoinMarketCap. CoinMarketCap (KDA market data)

- Tier 1: Protocol documentation: Kadena technical documentation covering Chainweb and the Pact smart-contract language. Kadena Docs (Chainweb + Pact)

- Tier 2: Security scope reference: CertiK Skynet profile for Kadena (current and historical context via archives where applicable). CertiK Skynet

- Tier 1–2: Ecosystem funding announcements: Primary announcements for Kadena ecosystem programs (2022 and 2025). $100M grants (Business Wire, Apr 2022) · $50M grants (Kadena, May 2025)

Where social-media posts or community commentary are referenced, they are treated as sentiment indicators rather than factual proof and should be cross-checked against primary announcements and archived sources.

Last reviewed: 18 January 2026